‘Helping Each other Help Ourselves’

R – Respect

O – Ownership

R – Reliable

U – United

M – Members

What is RORUM Credit Cooperative?

RORUM the first officially recognized Credit Cooperative was registered under Department of Agricultural Marketing and Cooperatives (DAMC) with the aim to enhance marketing capabilities of BAOWE members through the creation of Self Help Groups encouraging saving habits and entrepreneurial skills. This addresses the lack of exposure and confidence of its members who shy away from commercial banks and as a result have usually fallen through the gaps rendering them economically disadvantaged. The success of RORUM is in the simplicity of its plan, which is understood and appreciated by our members.

Vision: To create a sustainable and viable financial cooperative, responsive to the needs of its members.

Mission: Empowering members through provision of savings, credit and other related services at competitive rates aimed at improving their financial, social well-being along with providing financial literacy to its members.

Services provided to members

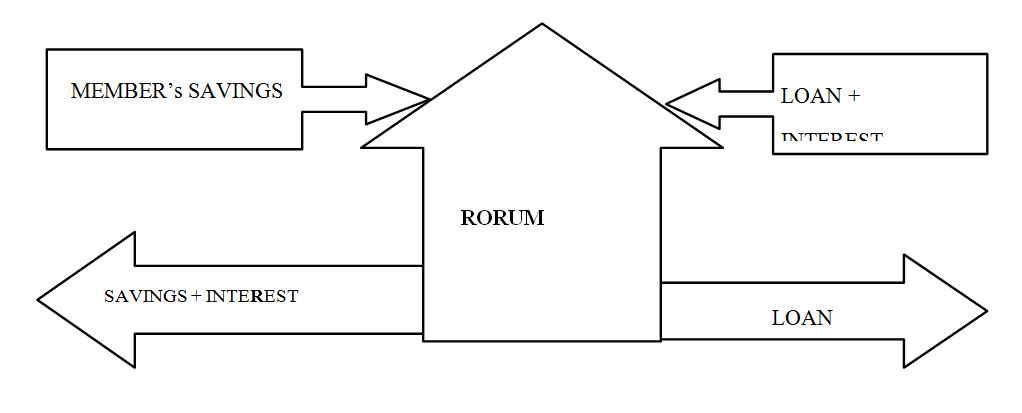

The Savings Aspect

RORUM encourages its members to save their money on a weekly basis encouraging saving habits providing competitive interest rates.

The Credit Aspect

Members can take loan from their accumulated group saving according to the amount of their savings and needs. A member availing loan should have at least 30% of the loan availed in personal savings account.

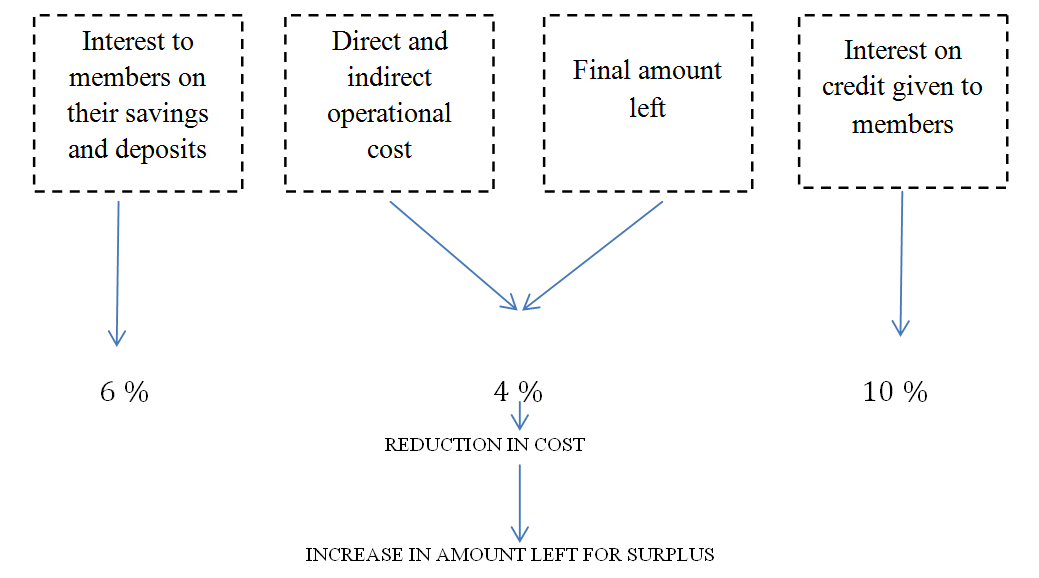

The Surplus

The surplus will be distributed among the members in proportion with the amount of their savings accumulated in the cooperative.